Highest food inflation since 1980

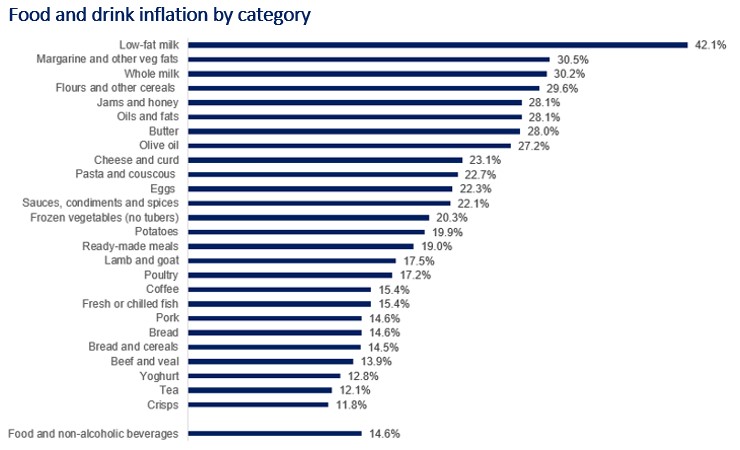

Prices of food and non-alcoholic drink continued their upsurge in September, with annual inflation accelerating to 14.6%, up from 13.1% in August, and estimated to be the highest since April 1980. September is the fourteenth consecutive month when annual food inflation has been accelerating.

Topics

UK inflation rose to 10.1% in September, up from August’s 9.9%. Food and non-alcoholic drink made the largest upward contribution to the change in the annual inflation.

Of the 49 main food categories reported in the official statistics, 38 recorded double-digit inflation. Dairy products saw the highest inflation rates, with low-fat milk 42.1% more expensive than a year ago, whole milk 30.2% and butter 28.1%. Chocolate saw the lowest gain in prices, at 3.3%.

Source: ONS

Food and drink manufacturers faced higher prices for their ingredients, with food ingredients produced in the UK being 16.7% more expensive (down from 17.2%, revised, in August) and imported ingredients 27.8% costlier (up from 25.6%, revised, in August). Goods leaving the manufacturers’ facilities—output gate prices, saw inflation inching up to 14.8% (up from 14.5%, revised, in August).

The relentless rise in producers’ prices means that food and drink inflation will continue unabated for the coming year, at least. It’s estimated it takes between seven and twelve months for rises in production costs to filter onto final consumer prices.

It’s noteworthy that imported ingredients were almost 30% costlier than a year ago. Most imports coming from non-EU countries are traded in dollars. As the sterling has been depreciating against the dollar since the beginning of the year, this means that non-EU imports have become more expensive. Some manufacturers are hedging against currency volatility and contracting their purchases of imports, effectively locking in prices for a period of time. However, once these contracting terms expire, new contracts will be drawn at higher prices.

Imported ingredients and raw materials are essential for UK manufacturers of food and drink. They complement local produce in added value products, providing inputs that aren't produced domestically or not in sufficient volumes and help create more sustainable export opportunities than commoditised trade. Imports help ensure security of supply for producers, enabling them to manage the inherent risk and uncertainty of seasonal production and variable climate conditions.

Besides crippling energy costs and labour shortages, the fall in the value of the pound is now adding to the long-running challenges faced by our industry. The last two years brought persistent rises in every cost component, against a background of extraordinary economic, political and geopolitical uncertainty.

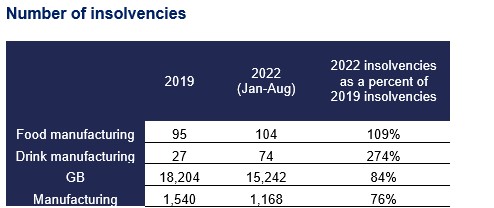

The weight of these trials is starting to manifest. During the first eight months of the year, there were more insolvencies in our industry than they were in the whole of 2019. Moreover, that is not the case for the manufacturing sector as a whole or Great Britain, another testament that the food and drink manufacturing has been disproportionately impacted by the turmoil of the pandemic and the war in Ukraine.

Source: The Insolvency Service, gov.uk

Households do not fare much better either. A looming recession, prospects of ongoing high inflation and rising interest rates mean that households will see their budgets squeezed further over the coming months. ONS surveys run between March and June showed that 35% of the British public was already spending less on food and essentials to deal to the cost of living. It’s not a surprise then that the mood in the UK economy is getting gloomier. The GfK consumer confidence fell to a new low in September, reaching its worst value since records began in 1974, with households particularly worried about both their own finances in the coming year and the state of the economy.

There are reasons to worry as the economy is in a difficult place. The government U-turn on the budget will have reassured the markets, but smaller household and business support will mean prolonged pains in the short-term.

The Bank of England is expected to raise interest rates at its next meeting on November 3, from the current level of 2.25% to 3.00%. High wage rises (nominal regular pay grew by 5.4% in August, the strongest growth since records started, excluding the pandemic period), coupled with low unemployment will keep the pressure on the Bank of England to raise interest rates further. But while higher interest rates will stifle growth, elevated wage pressures will not squash inflation, leaving the Bank facing a tough conundrum.

As a matter of urgency, businesses need a decision from the government on 70+ outstanding duty suspension applications for food and drink that were submitted by businesses before July 2021.

For fifteen months, importers have faced costly tariffs on products where in many cases there is no domestic UK production. As businesses struggle with rising costs of essential imported ingredients, these tariffs further inflate prices for producers and shoppers. These suspensions would help many struggling businesses and we ask that the government ends the uncertainty by confirming the successful applications.