Food inflation slows again

Topics

Food and non-alcoholic drink inflation eased for the ninth consecutive month in December to 8.0%, down from 9.2% in November. This is the lowest inflation rate since April 2022. The fall in annual inflation is explained by base effects. In reality, food prices continued to rise by 0.5% over the last month, following a rise of 0.3% in November, and the highest monthly pick-up since May 2023.

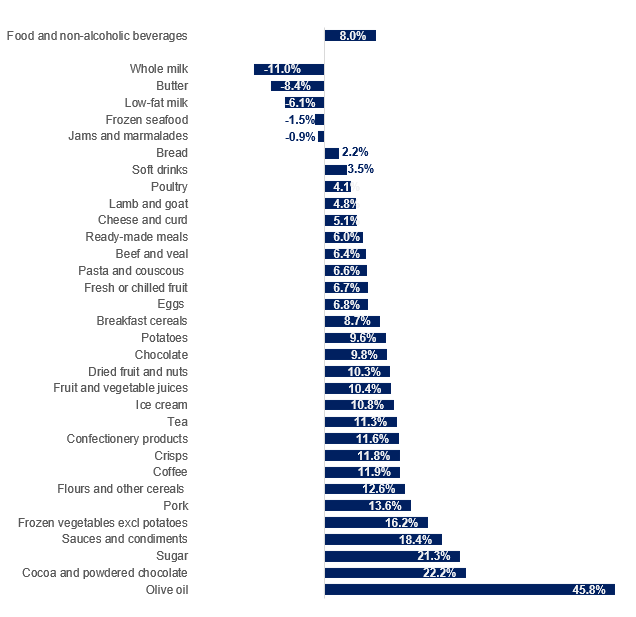

By category, prices fell on a yearly basis for five out of the main 49 categories reported by the Office for the National Statistics (ONS). Whole milk and butter were cheaper than a year ago, with prices falling by 11.0% and 8.4%, respectively (see chart). Olive oil and sugar inflation rates remained significantly high, although both have slowed in December to 45.8% and 21.3%, respectively.

Food and non-alcoholic drink year-on-year inflation by category (Dec-23 compared to Dec-22)

Source: ONS

On the producer side, although some costs were lower compared to a year ago, all costs were higher than in November. On the year, prices of UK-sourced ingredients decreased by 2.5%, a faster pace than November’s 2.3% rate. Prices of imported ingredients rose at a faster pace both on the year, at 10.4% in December, up from 7.7% in November, and on the month, by 2.7% in December, up from -0.6% in November. This suggests that we’re far from seeing inflationary pressures completely falling away.

The weather and geopolitics are key factors that will determine the price of ingredients in the future and, therefore, UK food inflation. Some of the effects will be felt in the coming months given it takes between seven and twelve months for input cost changes to reflect in retail prices. Global sugar prices fell to their lowest level in the past nine months driven by strong production in Brazil and India’s decision to limit the use of sugarcane for ethanol production. However, there have been significant worldwide price rises in cocoa – reaching a 45-year high, as significant rainfall resulted in a poor crop in Cote d'Ivoire, the producer of 70% of the world’s production. Recent UK floods have impacted some wheat and cereal crops, although with prices set globally for these commodities, it remains to be seen whether we’ll see any price impact in the future.

The recent crisis in the Red Sea has pushed up freight rates significantly, on average by about 95% since 12 December 2023 and even more for some routes, for instance: a 199% increase for China/ East Asia to Northern Europe route and 223% for Mediterranean to China/ Asia routes.

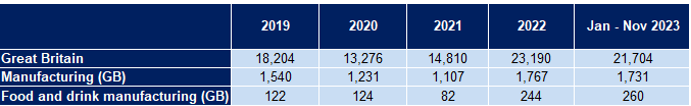

Labour shortages continue to add cost pressures for manufacturers coupled with a 9.8% rise in minimum wages due to come into effect this April. The last three years have taken a toll on the industry. Insolvencies have risen to unprecedented levels, reaching 260 over the first eleven months of 2023, compared to 244 during the whole of 2019. Insolvency rates in the food and drink manufacturing sector have more than doubled while insolvencies in the wider manufacturing sector rose by 12% (and 19% in Great Britain as a whole) over the same period.

Number of insolvencies

Source: The Insolvency Service

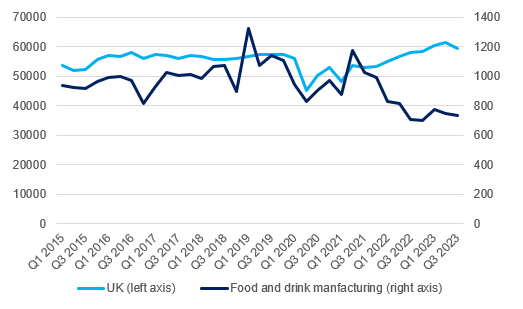

Moreover, stringent price pressures have also meant that businesses had to postpone and divert investment funds to day-to-day operations. Investment fell again in Q3, which means investment over the year to Q3 2023 was 33% lower than over the same period in 2019, after inflation effects have been removed.

Business investment (£ mill)

Source: ONS, chain volume measures, seasonally adjusted, 2019 reference year

This shows that this year will continue to be a difficult one for the industry, especially as consumer budgets remain strained, and manufacturers cannot recover their margins by putting up prices or benefitting from higher sales. In the wider economy, the annual CPI inflation rate saw a pick-up to 4.0% from 3.9% from November. Higher duty charges for alcohol and tobacco pushed inflation up, as did rises in recreation and clothing. These impacts were partially offset by falling inflation for food and the hospitality industry. Core inflation remained steady at 5.1%. Core inflation is closely watched by the Bank of England as it excludes more volatile items such as food and energy and it’s thought, therefore, to be a better measure of underlying inflation. While service inflation, another indicator thought to be a better measure for domestic price pressures, inched up to 6.4% from 6.3% in December.

Inflation is likely to slow in months to come, given base effects, approaching the Bank of England target of 2.0%. However, that will not necessarily drive the Bank of England to cut rates aggressively, unless there’s solid evidence of dissipating price pressures and of labour market cooling. Latest wage data shows that regular pay growth has slowed in November to 6.6% from 6.9% the previous month for the public sector and to 6.5% from 7.2% for the private sector. But ONS has had unsatisfactory response rates to its labour market surveys, which meant it was not able to publish its usual unemployment and inactivity data. The uncertain labour market data complicates the Bank’s decision.

As our sector emerges from this inflationary period, it’s critical that businesses can attract private sector investment in the UK. We need this to strengthen our sector’s resilience and ability to grow, while continuing to take the action necessary to play our part in transforming into a more sustainable and secure food system.