Seven months of easing food inflation

15 November 2023

Annual food price inflation eased for the seventh consecutive month in October to 10.1%, down from 12.2% in September. On the month, food prices rose by 0.1%, compared to a monthly decline of 0.1% in September, a sign that it will still take a while for prices to embark on a downward trajectory

Topics

- Inflation

- Business insights & analysis

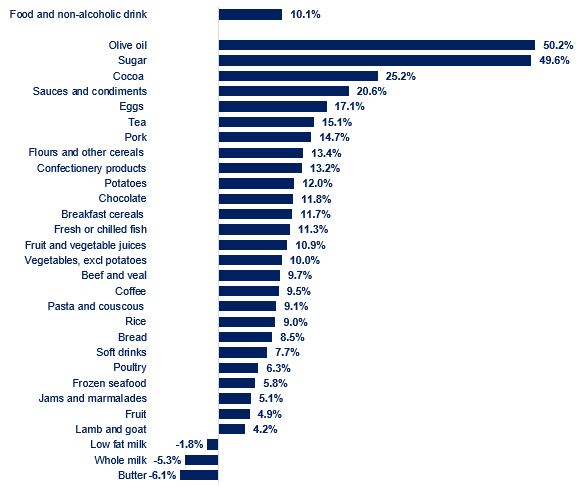

Year-on-year inflation has been slowing for 36 categories out of the 49 main categories reported by the Office for the National Statistics (ONS), with butter and milk firmly in deflationary territory. Butter prices were 6.1% lower compared to a year ago. In sharp contrast, olive oil and sugar continued to see eye-watering price rises of 49.6% and 50.2%, respectively (see chart). Unusual weather and the El Nino significantly impacted the worldwide output of both commodities.

Food and non-alcoholic drink year-on-year inflation by category (Oct-23 compared to Oct-22)

Source: ONS

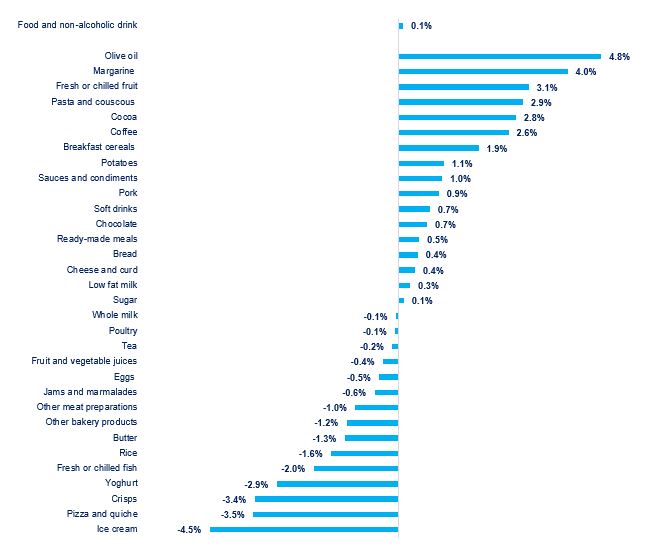

While prices are, on average, higher than a year ago, there’s hope on the horizon. For instance, prices of milk, poultry, tea and jams have fallen month-on-month for the past two months. Overall, 23 categories were cheaper in October than in September for, amongst which: ice cream (-4.5%), pizza and quiche (-3.5%) and crisps (-3.4%). Prices of olive oil and margarine increased significantly, by 4.8% and 4.0%, respectively.

Food and non-alcoholic drink month-on-month inflation by category (Oct-23 compared to Sep-23)

Source: ONS

On the producer side, some costs are falling. UK-sourced ingredients were 1.9% cheaper compared to a year ago, but 0.7% more expensive on the month. This is the first time in five months when ingredients produced in the UK saw a pick-up in prices compared to the previous month. Imported ingredients were 9.0% more expensive on the year and 0.6% on the month. Overall costs facing food and drink manufacturers rose on an annual basis by 0.3% in October, and by 0.4% on the month.

The monthly cost increases, especially the reversal to a rise in domestic ingredients, shows that many inflationary pressures persist and that the inflation battle is not over yet. Labour shortages continue to challenge the industry and to put pressures on manufacturers’ labour cost bill. The weakening of the sterling relative to the dollar, due to a rise in US yields and a strong US economy, drove the sterling to its 6-month low and pushed up the cost of imports as most agricultural commodities are traded in US dollars. Adverse weather patterns and low fertiliser use over the last year have brought about reduced crops or lower yields and quality, or both. All of this means that there are ongoing inflationary pressures in the supply chain.

The Bank of England predicts that food inflation will average 9% over Q4 and around 5% for the first three months of 2024. And while that is likely to happen, the difficulty will be in bringing down the inflation rate further.

A new OC&C study shows that operating margins across the top 150 manufacturers fell from 6.2% to just 3.9% in 2022, an all-time low in the near 40 years since records started. Manufacturers had absorbed a significant share of the massive rise in costs seen over the last couple of years. It’s likely many of them do not have the ability to absorb more costs.

Equally, the cost of living crisis left many households in a dire financial situation, as shown by the persistent decline in grocery sales volumes and the substantial shift to own-label products.

In order to grow and rebuild margins, manufacturers need to either be able to raise prices or increase sales, both of which seem a distant possibility today. Against wider developments in the industry, this is worrisome.

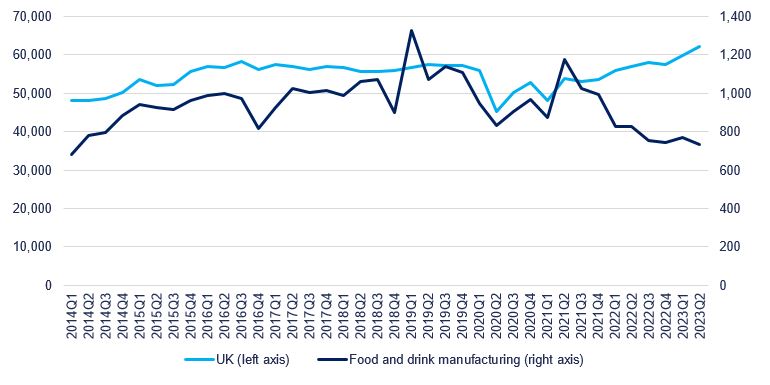

Industry’s investment has been on a steep downward trajectory since Q3 2021. During the first half of 2023, compared to the first half of 2019, business investment in the industry was 36% lower and 17% lower compared to the first half of 2016. That stands in sharp contrast with the rise in UK investment by 7% compared to four years ago or 6% compared to seven years ago. Investment is the engine of future growth and the fall in investment will likely have negative impacts on the future growth of the industry, innovation and the competitiveness of the UK food and drink globally.

Businsess investment in the food and drink manufacturing and the UK, £mill

Source: ONS, Business investment, chain volume measures, NSA

The difficult economic climate in recent years is also reflected in the insolvency data. In 2022 the industry saw the number of insolvencies double compared to 2019, and it’s likely that 2023 will see this trend continue. Over the eight months to August, the industry surpassed the 2019 figures by 62%. In contrast, insolvencies in Great Britain over the same period had not yet reached the 2019 level, they are 5% below, and in manufacturing as a whole: 9% below.

This means that many challenges lay ahead for the industry.

In the wider economy, the annual CPI inflation rate slowed to 4.6%, down from 6.7% in September. Core inflation – a measure excluding more volatile items such as food and energy and considered a better measure of underlying inflation – has eased to 5.7%, down to 6.1% in September. These movements reflected in part a fall in food and energy prices – the Ofgem’s cap was reduced to reflect lower wholesale gas prices.

This sharp drop in inflation is likely to mean that the Bank of England will not raise interest rates any further. However, it’s probably a while until we will see a cut in rates, as the Bank will need to see further price inflation easing, as well as wage growth slowdown.

For the industry to rebuild its resilience after the shocks of recent years, we need the government urgently to review the conditions for investment in our sector. Making full expensing permanent in next week’s Autumn Statement would be significant in terms of incentivising investment. As would concerted government action to improve existing and planned regulation that is adding avoidable costs to the industry, from Extended Producer Responsibility, the Plastics Packaging Tax, “Not for EU” labelling and the Apprenticeship Levy.