Food inflation eases once more

Topics

Annual food and non-alcoholic drink inflation slowed for the eleventh month in February to 5.0%, down from 7.0% in January. This is the lowest annual rate since January 2022. On the month, prices rose by 0.2%, following a decline of 0.4% in January.

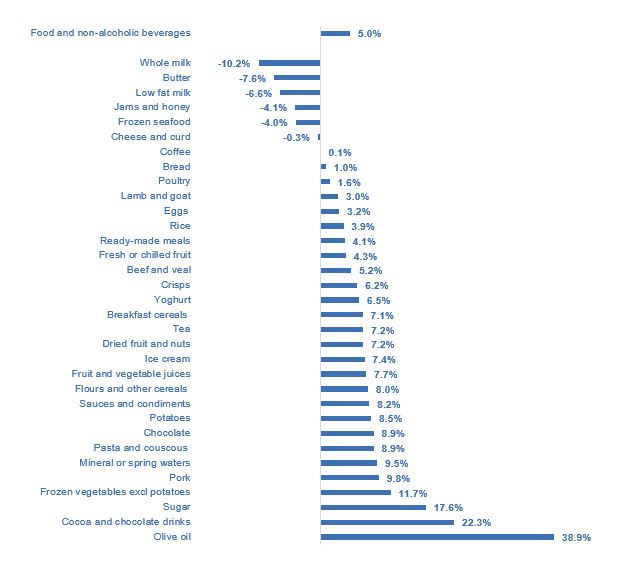

In February, six categories out of the 49 reported by the Office for the National Statistics (ONS) were in deflationary territory, with prices of whole milk and butter dropping at the fastest annual pace of 10.2% and 7.6%, respectively. Inflation slowed for 38 of the remaining 43 categories. Notably, olive oil and ‘cocoa and powdered chocolate drinks’ saw significant price increases of 38.9% and 22.3%, respectively.

Food and non-alcoholic drink year-on-year inflation by category

Source: ONS

Cocoa prices have skyrocketed by 73% since October 2023 and nearly tripled since January 2022. This surge stems from adverse weather conditions affecting yields in Cote d'Ivoire and Ghana, along with long-standing underinvestment in these regions, resulting in stretched cocoa supplies. Decades of low cocoa prices left farmers cash-strapped and unable, in most cases, to afford fertilisers or plant new trees to boost their production. These are structural issues, which will take time to be resolve and mean that higher cocoa prices will remain for some time.

Cocoa prices (US$/tonne)

Source: The International Cocoa Organisation (ICCO)

Most cost pressures have now subsided with manufacturers facing overall costs that were 1.5% lower than a year ago, and 1.0% lower on the month. UK-sourced ingredients have been in deflationary territory for six consecutive months now. In February, annual prices fell by 2.4%, the steepest decline of the last six. Compared to last month, UK ingredients were 0.8% cheaper. While prices of imported ingredients continued to rise on the year, February’s inflation rate of 0.5% was the lowest increase since October 2021. On the month, prices of imported ingredients fell by 0.5%.

But some costs continue to rise. For example, persistent labour shortages and the cost of living crisis have continued to push wages up. Forthcoming pay increases this April, driven by a record rise of 9.8% in the National Living Wage (NLW), will be challenging for businesses particularly for SMEs. NLW rises will have implications for retailers, with a large share of their workforce on minimum wages, and therefore increasing pressures on retail prices.

The recovery of the industry hinges on its ability to invest. ONS data shows business investment in the industry to be a third lower than four years ago. FDF Q4 State of Industry Survey reported that three quarters (73%) of manufacturers are prioritising growth of their UK sales and two thirds (66%) of them new product development.

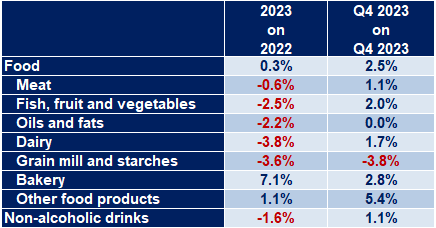

With most food and non-alcoholic drink subsectors shrinking in 2023, manufacturers’ desire to regain lost ground is not surprising. As the below table shows, only the bakery sector and ‘other food products’ (which includes foodstuff such as sauces, condiments and spices, ready meals), saw positive growth last year. Moreover, some subsectors (dairy, grain milling, fish, fruit and vegetables) saw a significant contraction due to the cost of living crisis.

However, some manufacturers might find it difficult to invest without seeing either higher demand (so an increase in volumes sold) or higher prices. Recent wage growth recovery offers some hope on the demand front, although 38% of the population reported in March they are buying less food in order to deal with financial burdens. Stretched household finances and retailers’ pressures make it unlikely for manufacturers to be able to recoup their lost margins through price hikes.

In summary, challenges persist for manufacturers, indicating that they have not yet emerged from the difficulties of the last few years.

Growth in the food and non-alcoholic drink manufacturing, by subsector

Source: ONS, Gross value added, chained volume measures, UK, seasonally adjusted

In the wider economy, February’s inflation figures were good news on all fronts. Headline CPI inflation eased to 3.4%, down from 4.0% in January and below market expectations of 3.5%. Core inflation slowed to 4.1% down from 5.1% in January. Core inflation is closely watched by the Bank of England as it excludes more volatile items such as food and energy and it’s thought, therefore, to be a better measure of underlying inflation. While service inflation, another indicator thought to be a better measure of domestic price pressures, decelerated to 6.1% from 6.5% in January. These figures are consistent with the view that inflation will reach a point below the Bank of England’s target of 2% in the next couple of months.

However, the Bank of England remains worried about the level of pay rises and service inflation which appears stickier. Growth in wages in the economy has been slowing recently, although in regular pay growth has been positive since June of last year. In January, regular pay rose by 1.6% in real terms and 6.1% in nominal terms, compared to 1.9% and 6.2%, respectively, the previous month. Markets believe that the bank will start cutting rates by 0.25 percentage points in June.

Investment in our industry is worryingly low if the UK is to build greater resilience in its food system and strengthen its food security. And the government is making UK food and drink less attractive to invest in with its insistence on UK-wide ‘not for EU’ labelling. This is an expensive and unnecessary policy that will particularly hit small businesses and exports, and we’re urging the government to reconsider. There are good, digital alternatives if the government wants to monitor food movements in the UK, which in time could also be adapted to ease checks with the EU.