Food inflation near 3-year low

Annual food and drink inflation slowed to 1.7% in May, the slowest annual rate since October 2021 and the 14th consecutive month of easing.

Topics

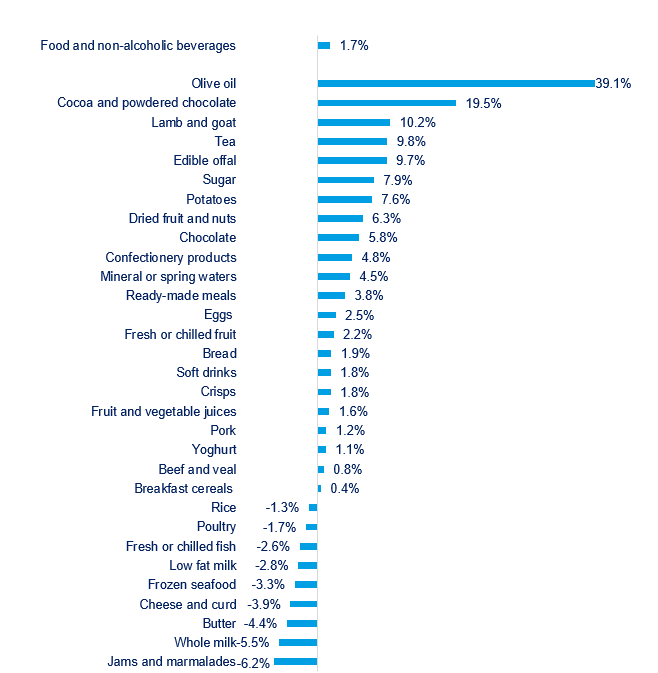

Despite this overall fall in food and drink inflation, it is a mixed picture for individual categories, with 15 out of the 49 categories reported by the Office for the National Statistics (ONS) in deflationary territory while inflation is easing for 22 of the remaining categories. Prices fell for ‘jams and marmalades’, whole milk and butter by 6.2 %, 5.5 percent and 4.4 % respectively (see chart below), while olive oil, ‘cocoa and powdered chocolate’ and ‘lamb and goat’ saw that highest inflation rates at 39.1%, 19.5% and 10.2%, respectively.

Food and non-alcoholic drink year-on-year inflation by category

Source: ONS

On the month, prices fell by 0.3%, first monthly decline since January.

In terms of upcoming pressures, there’s also a mixed picture. May was the seventh consecutive month of annual deflation for overall costs to manufacturing. In May, total costs fell by 0.5%, a slower decline than April’s 0.7%. Prices that manufacturers paid for imported ingredients also decreased year on year by 4.8%, while UK-sourced ingredients rose by 1.2%, a second rise in a row. On the month, overall costs rose by 0.5%, with costs of imported ingredients fell by 1.0% while domestic ingredients increased by 1.0%.

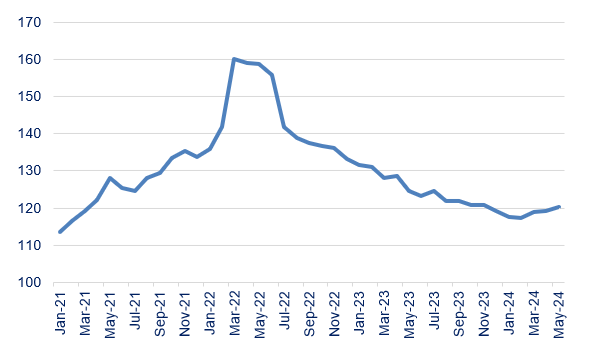

For the medium term, it appears that some volatility is re-emerging, with parts of the food and drink supply chain remaining vulnerable. Global agricultural commodity prices increased for the third consecutive month in May, mainly driven by markets apprehensive about weather impacts on crops and yields. This high uncertainty complicates planning and day-to-day operations for food manufacturers.

Global agricultural commodity prices

Source: UN FAO Food Price Index

At the same time, oil markets have seen greater fluctuations over the past three months, while ongoing disruptions in the Red Sea pushed UK gas prices up by about 40% since February, as transport of LNG was disrupted, and shipping rates continue to rise.

We've noticed some green shoots of recovery over the past few months, but the industry has not yet bounced back. As there’s little slack remaining in the food supply chain to deal with new challenges, heightened volatility is a key concern.

In the wider economy, CPI inflation slowed to 2.0% from 2.3% in April, the first time the rate has hit the Bank of England’s inflation target since July 2021. While that is great news, core and services inflation are trending higher. Core inflation is a better measure of underlying inflation as it excludes more volatile items such as food and energy, slowed to 3.5%, down from 3.9% in April. While service inflation, another indicator thought to be a more accurate measure of domestic price pressures, inched down to 5.7% from 5.9% in April.

At the same time, wage growth continued strong, with UK pay rising at the same rates in April as it did in March. Average regular pay saw growth of 6.0% and total pay of 5.9%.

In light of all this, it’s likely that the Bank of England’s Monetary Committee meeting on Thursday will decide to hold interest rates unchanged. Nevertheless, the drop in headline inflation means that wage growth will likely moderate in the coming months, with some market participants expecting a rate cut in August.

However, as politicians campaign across the country, we can’t stress enough the centrality of good food and drink to everyone’s lives and that the resilience of our sector isn’t a given. It’s crucial that the next government works closely with our sector to ensure sufficient investment to guarantee the UK’s food security alongside economic growth. With the right incentives and the right regulation, our sector – the largest manufacturing sector in the country – should be a powerhouse for science and innovation, good jobs and community prosperity.