Lowest food inflation in three years

Topics

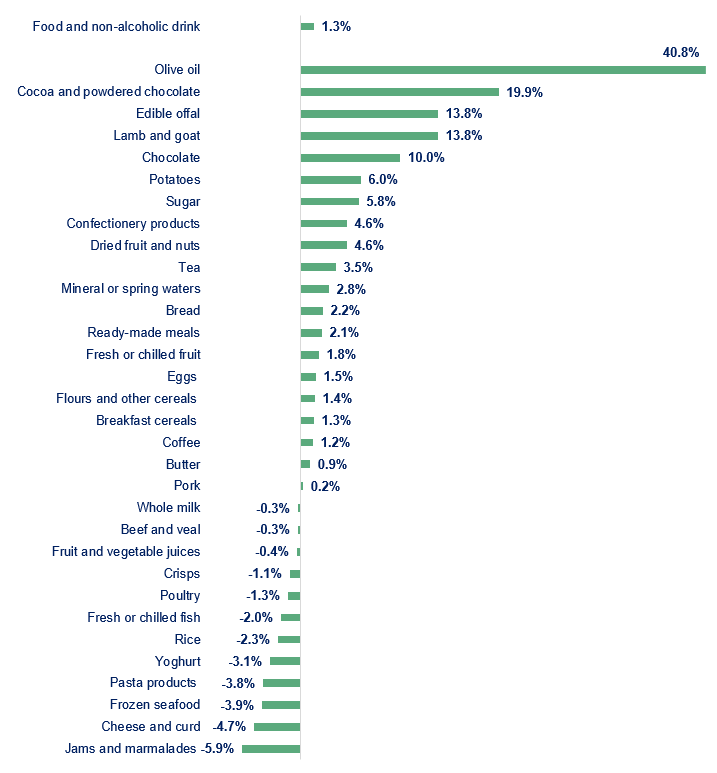

Annual food and non-alcoholic drink inflation eased to 1.3% in August, down from 1.5% in July. This is the lowest annual rate since September 2021. On the month, prices rose by 0.2%.

There was a mixed picture for individual categories. 21 out of the 49 categories reported by the Office for National Statistics (ONS) were in deflationary territory in August, while inflation was below 5.0% for 19 categories. Price fell the fastest for ‘jams and marmalades’ and ‘cheese and curd’ by 5.9% and 4.7%, respectively, while olive oil, ‘cocoa and powdered chocolate’ and ‘lamb and goat’ recorded the highest rises at 40.8%, 19.9% and 13.8%, respectively.

Food and non-alcoholic drink year-on-year inflation by category

Source: ONS

Overall, inflation appears to have stabilised across most categories, with the exception of a few impacted by adverse weather conditions. Notably, olive oil prices have remained exceptionally high due to extreme droughts in key producing regions over recent years. In the UK, prices began to rise in early 2022, with retail olive oil costs soaring by 143% between January 2022 and August 2024. However, the outlook is positive, as major producers like Spain (the largest globally), Greece, Portugal, and Turkey are expected to have strong harvests this autumn.

Global cocoa prices have been elevated this year due to disease outbreaks and unfavourable weather in Ghana and Ivory Coast, which together supply over 60% of the world's cocoa. While better harvests are anticipated this autumn, Ghana has raised its fixed farmgate price by nearly 45% to support farmers and curb bean smuggling, with Ivory Coast expected to follow suit. As a result, cocoa prices are likely to remain high for the foreseeable future.

The high inflation rate for lamb meat is largely attributed to rising British lamb prices, which were affected by cold, wet weather and livestock diseases earlier in the year.

Retail price stabilisation reflects a broader stabilisation in costs. According to ONS data, input costs (excluding labour) have remained steady over the past year. In August, overall input costs fell by 0.7% year-on-year, with UK-sourced ingredients also decreasing by 0.7%, while imported ingredients were 3.2% more expensive.

With costs broadly stable, and retail inflation in line with historical averages, it’s easy to believe that the industry has turned the corner. But the last challenging years left manufacturers with eroded margins which have not yet been recovered and a sharp, persistent drop in investment since the beginning of 2020, now a third lower. For investment to recover, it’s essential for margins to improve. It’s not surprising then, that growing UK sales remain the top priority for the industry.

In the wider economy, CPI inflation was steady at 2.2%, slightly above the Bank of England’s target of 2.0%. Some underlying pressures remain. Core inflation, which excludes more volatile items such as food and energy, accelerated to 3.6%, up from 3.3% in July. Meanwhile service inflation, another indicator thought to be a more accurate measure of domestic price pressures, also rose to 5.6%, up from 5.2%. The main driver behind this pick-up were airfares, primarily driven by a 22% rise in airfares between July and August. Despite this uptick, airfares are known for their volatility and are not a major concern.

Markets believe that inflationary pressures will continue to ease, especially as pay growth slows. Over the three months to July, regular pay rose, on average, by 5.1% and total pay by 4.0%, down from 6.0% and 5.9%, respectively, over the three months to April.

The Bank of England believed the economy was evolving broadly as expected, and left rates unchanged at 5.0% at their August meeting, having cut rates at its last policy meeting and in line with market expectations. Forward policy includes more gradual cuts “gradually over time”.

Investment in our sector is key to ensuring it can continue to prosper and grow. By putting the food and drink industry at the heart of its industrial strategy, government can strengthen the nation’s food security, boost investment, and support more jobs. Furthermore, with export volumes down 20% in the first quarter of 2024 and recent import regulations creating administrative barriers, it’s vital that government prioritises easing the bureaucratic burden and cutting unnecessary costs and processes in order to strengthen the relationship with our largest trading partner, the EU.