Food inflation below headline inflation

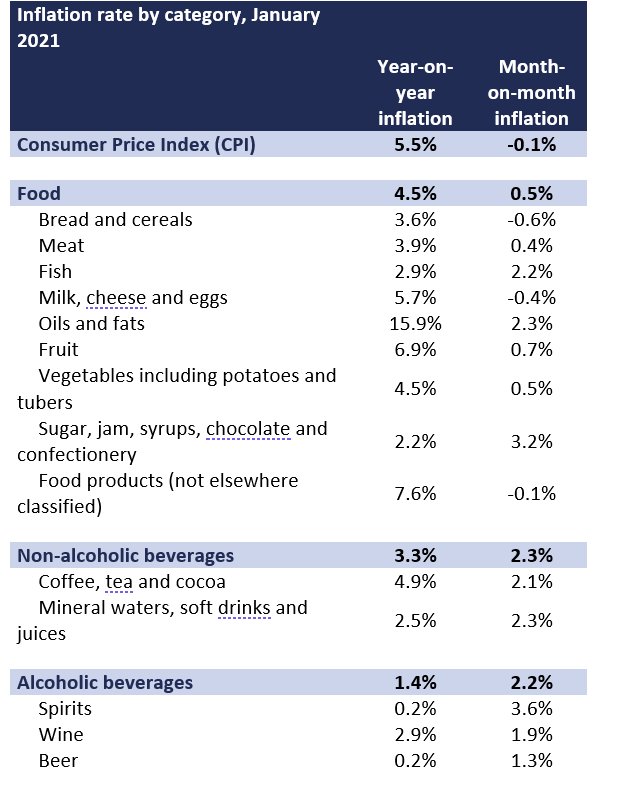

Annual inflation for food and non-alcoholic drink inched up to 4.3% higher in January, up from 4.2% in December. This is the largest increase since September 2013. Prices rose for all product categories, with the highest annual increases being recorded for oils and fats (15.9%), fruit (6.9%), and coffee, tea and cocoa (4.9%). Restaurant prices picked up pace too, with inflation reaching 4.3%.

Topics

Food prices will continue rising throughout 2022. Imported food materials by producers were 5.6% more expensive in January than a year ago and yearly food output inflation, which refers to production leaving manufacturers, stood at 6.0%. Producer prices lead consumer prices, so these figures suggest food inflation is likely to pick up over the next few months.

The current rise in food prices is the result of myriad of challenges that confronted the industry over the past two years. The pandemic brought lockdowns and changes in migration patterns, making the production of raw materials more expensive, with global vegetable oils prices 91% higher and cereals prices 41% higher. The shift in worldwide consumption patterns from services to goods severely disrupted supply chains, leading to five-fold increases in average global shipping costs since November 2019. The global economic recovery in 2021 increased global oil consumption, such that oil prices climbed 60% over the last year and the energy crisis brought double-digit rises in gas and electricity prices. In addition, the industry has been confronted with severe labour shortages.

All of this means that production costs have soared and passing on some of these increases is now unavoidable. Moreover, the industry needs resources to invest. Current supply chain and cost pressures are weighing heavily on businesses, impeding their growth and innovation abilities, and upcoming regulation adds to these pressures.

In the wider economy, headline inflation ran even higher in January, with prices increasing by 5.5%. Higher rise prices will undoubtedly hurt consumer’s budgets, especially as energy prices will rise by 54% from April. The Government will help alleviate some of the pain with a universal £200 rebate on electricity bills, which will reduce the effective increase to 39%, but that is still a striking increase and will only kick in from October. Less affluent households will bear the brunt of these rises as they spend a higher share of their disposable income on food and energy and are less likely to hold savings. Specifically, the poorest 10% of UK families spend 14% on food and non-alcoholic drinks and 23% of their disposable income on housing, fuel and power. That compares to 11% and 14%, respectively, for the average UK household.

The outlook for 2022 remains one of high inflation by historical standards. The Bank of England has projected inflation to peak at 7.25% in April 2022, declining to 5.2% by the end of the year, though some market analysts believe that inflation will run even higher.

Recent data offers a glimmer hope that the strain on global supply chains might be subsiding. IHS Markit PMI data shows that UK manufacturing saw input inflation easing to a nine-month low in January. The ONS input inflation also slowed. This means that inflation will recede in 2023, as long as labour shortages lessen as well.

Commenting on these figures, Chief Executive of the Food and Drink Federation Karen Betts said:

“Today's continuing rise in the price of everyday food and drink is worrying - particularly for lower income households. Food and drink manufacturers are working hard to keep prices down but are being hit hard by rising energy, ingredient and logistics costs, which for the moment show no signs of abating, alongside dealing with acute labour shortages.

“It's becoming increasingly difficult for companies - large and small - to remain competitive and upcoming regulation is compounding the situation. This puts a premium on good collaboration between government and industry to guarantee that planned regulation is successful and does not place unnecessary burdens on businesses at an already challenging time.”