Food inflation firmly in low territory

Topics

Annual food and non-alcoholic drink inflation slowed for the 15th consecutive month in June, dropping to 1.5% from 1.7% in May and 17.4% a year ago. This is the lowest annual rate since October 2021. On the month, prices rose by 0.2%, following a 0.3% decline last month.

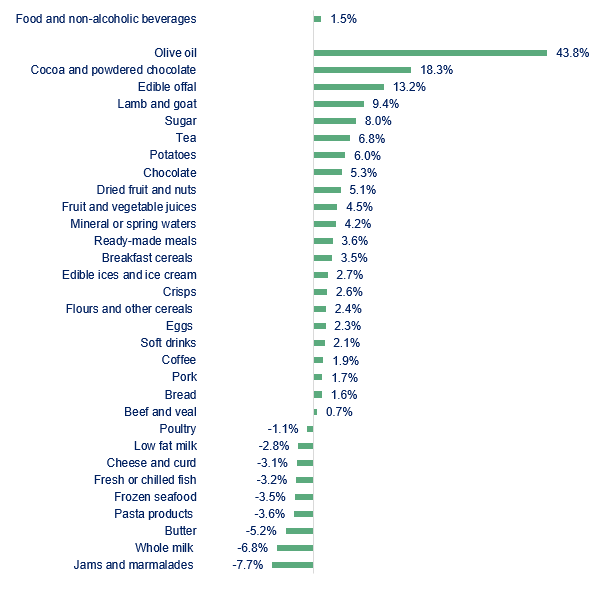

There is a mixed picture across categories. Among the 49 categories reported by the Office for National Statistics (ONS), 18 had experienced deflation, and 20 saw inflation below 5.0%. Prices fell the fastest for ‘jams and marmalades’, whole milk and butter, by 7.7%, 6.8% and 5.2 % respectively (see chart). Conversely, olive oil, ‘cocoa and powdered chocolate’ and edible offal saw the highest increases at 43.8%, 18.3% and 13.2%, respectively.

Food and non-alcoholic drink year-on-year inflation by category

Source: ONS

June marked the eighth consecutive month of annual deflation for overall input costs to food and drink manufacturers, excluding labour costs. Total input costs fell by 0.1%, a slower decline than May’s 0.7%. Prices for imported ingredients decreased by 3.2%, down from a 4.9% fall in May, while UK-sourced ingredients rose by 1.5%, up from 0.8% in May, the third consecutive increase. Pay growth and labour shortages are ongoing pressures for producers.

The overall picture for the industry now is one of more stabilised business conditions. Labour aside, input costs have largely stabilised. Some uncertainty remains about future energy prices, while geopolitics, extreme weather conditions and labour and skill shortages remain as potential sources of risk. The significant challenge for the industry now is to find the resources to increase investment, which in 2023 was 30.5% lower than it was in 2019, in contrast to the UK as a whole where investment had rose by 5.4%.

The most recent FDF State of Industry Survey found that most producers were focused on growing their UK sales. However, household finances remain strained despite recent wage increases. Although wages have risen in real terms for eleven months as of April, this has not offset the decline seen in the previous 18 months. The cost of living crisis has led consumers to reduce grocery purchases (ONS figures show that May food retail sales were 3.0% lower in volume terms compared to May 2019), and shift to cheaper or own-label products.

In the wider economy, CPI inflation was steady at 2.0%, hitting the Bank of England’s target for the second time since July 2021. Still, underlying price pressures remain strong. Core inflation, which excludes more volatile items such as food and energy, came in at 3.5%, the same rate as in May, while service inflation, another indicator thought to be a more accurate measure of domestic price pressures, was also steady at 5.7%.

At the same time, wage growth remains relatively strong, with UK pay rising at the same rates in April as it did in March. Average regular pay saw growth of 6.0% and total pay of 5.9%. Wage growth is expected to slow, as headline inflation has been falling.

Nevertheless, for the very short term, the persistence of wage growth and of services and core inflation leaves the Bank of England with a difficult decision in August when it meets to decide upon interest rates. Today’s data may not give policymakers the confidence that price pressures are under control, suggesting that rates will remain unchanged in August. Following today’s data release, market participants thought there is now a lower chance of a rate cut in August.

For the industry, stabilising input costs will help to restore business confidence and stimulate the critical investment we need to see in food and drink, the largest manufacturing industry in the UK. Our industry is at the heart of the everyday economy and the prosperity of our communities, and central to job opportunities and skills development. Investment is key to safeguarding food security and the resilience of our food and drink sector.

Investment in food and drink manufacturing fell between 2019 and 2023 by 30%. Our priority is to work in partnership with the new government to address this, and to ensure that the right incentives are in place, alongside regulation that enables business growth and fosters productivity and innovation.