Food inflation has stabilised

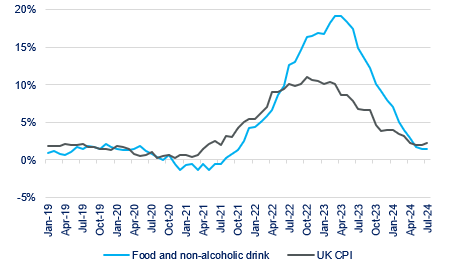

Annual food and non-alcoholic drink inflation was steady at 1.5% in July. This, alongside the June figure, is the lowest rate since October 2021, having seen 15 consecutive months of slowing price rises.

Topics

There is a mixed picture for individual categories. 20 out of the 49 categories reported by the Office for the National Statistics were in deflationary territory in July, while inflation was below 5.0% for 17 categories. Prices fell the fastest for frozen seafood, and ‘jams and marmalades’ by 8.1% and 5.4% respectively, while olive oil, ‘cocoa and powdered chocolate’ and ‘lamb and goat’ recorded the highest rises at 37.5%, 19.6% and 12.3%, respectively.

On the month, prices did not change.

Food and non-alcoholic drink inflation has now been lower than UK headline inflation for three months (see below chart).

Food and non-alcoholic drink year-on-year inflation by category

Source: ONS

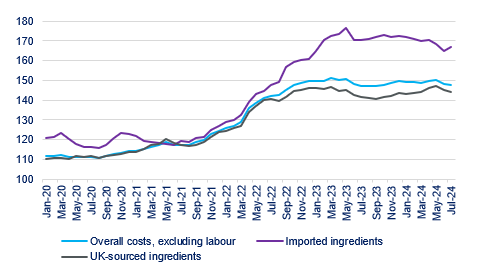

Meanwhile, production costs have been stabilising, with input costs, excluding labour, largely unchanged over the past year (see below chart). This means that the impacts of the structural shocks of the pandemic and the war in Ukraine on food inflation have now dissipated. Nevertheless, the lasting impact seems to be higher costs throughout the supply chain, which means that we’re unlikely to see prices drop. Adverse weather, geopolitics and new EU trade measures on imports (health certificates and check rates at the border) pose risks to inflation.

Manufacturers’ costs (excluding labour costs), Indices, 2015 =100

Source: ONS

All of the above seems to indicate that the industry is turning a corner. But for the industry to rebuild from a difficult few years and create sustainable growth, it needs to focus on investment and innovation. Challenging conditions over the last years have meant that businesses postponed or cancelled investment projects and diverted funds to day-to-day operation. As a result, investment in the industry dropped. In 2023, the industry’s investment was 30.5% lower than in 2019, contrasting with the UK as a whole where investment was 5.4% higher, and in Q1 2024 it continued to drop.

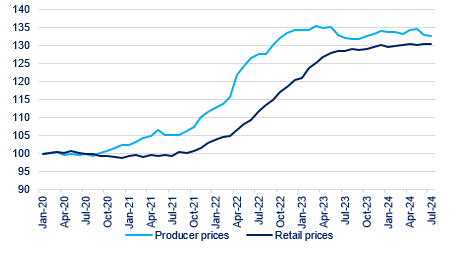

To invest, businesses need resources, and margins have been eroded. The last four years saw their costs rise at a faster pace than retail prices (see chart below), which means that producers have absorbed a share of the cost rises. This one-to-one comparison between costs and prices is possible because the indices have been rebased to 100 in January 2020. A similar starting point/ base allows for such comparisons.

The industry needs to increase volumes, both at home and abroad. The most recent FDF State of Industry Survey found that most producers were focused on growing their UK sales. With falling exports and household finances still constrained, the road ahead seems quite difficult. Despite recent rises in real wages, about 40% of consumers continue to rein in their spending.

Manufacturers’ costs (excluding labour costs) versus food and non-alcoholic drink retail prices

Source: ONS

The government’s Industrial Strategy will be critical in setting out a long-term strategy for the UK economy and providing stability that will attract both public and private sector investment opportunities.