Food & drink exports continue to fall in 2024, as UK manufacturers look beyond the EU to boost trade

20 December 2024

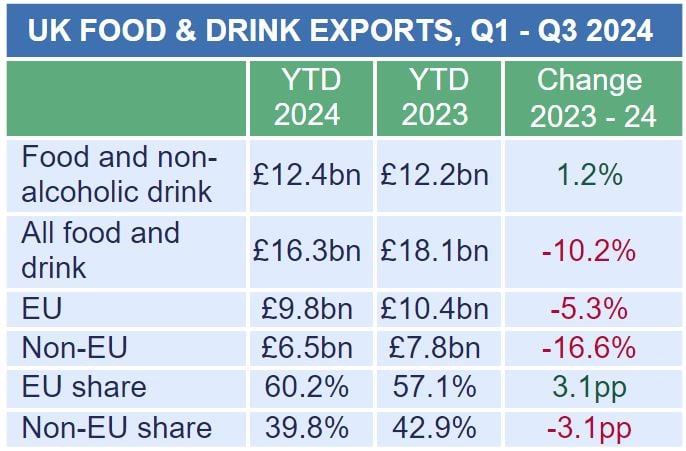

We've released our latest Trade Snapshot report, revealing that food and drink exports have continued to fall in Q3, with exports in the first nine months of 2024 down 10.2% to £16.3bn, driven by a significant drop in alcohol sales.

Read our full press release below.

Topics

- International trade

- News & media

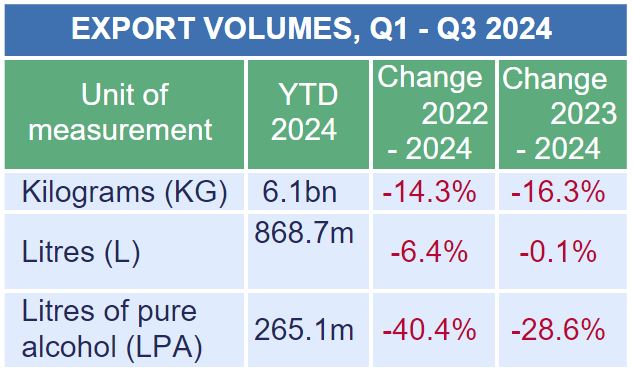

Food and drink exports have continued to fall in Q3, with exports in the first nine months of 2024 down 10.2% to £16.3bn, driven by a significant drop in alcohol sales. While the value of food and non-alcoholic drink exports remained steady (up 1.2%), this masks a fall in volume of 16.3%, an impact of high food and drink inflation and trade barriers.

The EU remains the UK’s biggest trading partner for food and drink. While exports to Ireland and Germany rose slightly by 3.0% and 1.4% respectively, these were the exceptions. Overall, exports to the EU have fallen 5.3% in the first nine months of the year, with the persistent administrative burdens that continuing to create barriers to trade with Europe. Targeted export support and a concerted focus on removing unnecessary paperwork, particularly for small and medium sized businesses, would be invaluable in helping the sector to recover this lost trade.

US trade

The US is the UK’s third largest customer, with over 10% of all our food and drink exports destined for the country as American consumers continue to enjoy iconic British products. The UK exported 460 million cups of tea1 and 436 million biscuits2 to the US in the first nine months of 2024.

The UK has a trade surplus with the US, meaning that while we received £1.0bn of food and drink so far this year – ranging from nuts and condiments to wine and vodka – we exported £1.6bn of products. Maintaining strong relationships with this important trading partner can play a key role in growing food and drink’s exports, particularly outside the EU where ongoing bureaucracy is creating barriers to trade. However, with exports to the US down 7.9% so far this year, any opportunity to reduce the friction at borders and avoid any tariff increases would help the UK to maintain and grow trade with this high value market.

The Comprehensive and Progressive agreement for Trans-Pacific Partnership (CPTPP)

On 15 December the UK officially joined the Comprehensive and Progressive agreement for Trans-Pacific Partnership (CPTPP) – a trade agreement of 12 nations3, predominantly in the Asia-Pacific region. In joining the bloc, the UK will now have tariff-free access when trading many products with Malaysia; improved export terms for several markets; and quicker border processes, which is particularly important for shorter shelf-life products. As more countries join the Partnership, the UK will have the opportunity to develop new trading relationships.

CPTPP countries are the UK’s second biggest supplier of ingredients to the UK after the EU, with imports from the bloc rising 9.7% so far this year. After joining the CPTPP, manufacturers will be able to import products like soy sauce, sesame oil, and cocoa butter tariff-free. As well as removing tariffs, UK businesses will benefit from more generous Rules of Origin, including cumulation provisions. This means that manufacturers can use ingredients sourced from any of the CPTPP nations and their product can still be traded without tariffs among the bloc.

Balwinder Dhoot, Director of Industry Growth and Sustainability, The Food and Drink Federation, said:

“These figures highlight the challenges that UK food and drink continue to face when selling their products abroad. This is particularly true for the 12,000 SMEs in our industry, who struggle to overcome the administrative burdens of exporting. Providing more support for these businesses will help the UK strengthen its international trade and maintain its position on the global stage.

“However, there are many exciting opportunities beyond Europe. With millions of American consumers continuing to enjoy the iconic British tea and biscuits, it’s important that we maintain our positive trading relationship with this high value market.

“Meanwhile, in joining the Comprehensive and Progressive agreement for Trans-Pacific Partnership, CPTPP, we’ve strengthened our relationship with 11 new countries. By gaining these better terms for trading and removing friction at borders, food and drink manufacturers can access more markets and create more resilient supply chains.”

-Ends-

Note to Editors

- FDF has compiled the latest trade figures released by his Majesty’s Customs and Excise. The H1 2024 Trade Snapshot report can be found here.

- An overall volume figure for food and drink can’t be fully obtained as different products are measured in different ways, such as kilograms and litres. Volume figures give a better indicator of the trade picture as they capture both changes in prices – inflation and changes in quantities traded. Products measured in kilograms are mostly food.

References

- 1.382 million kgs of tea was exported Jan-Sept 2024. Based on the average teabag weighing 3g.

- 6.548 million kgs of sweet biscuits were exported Jan-Sept 2024. Based on the average biscuit weighing 15g.

- CPTPP members include Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the UK and Vietnam.